1. Short title and commencement. – (1) These rules may be called the Companies (Appointment and Qualification of Directors) Rules, 2014.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. Definitions.- (1) In these rules, unless the context otherwise requires, –

(a) “Act” means the Companies Act, 2013 (18 of 2013);

(b) “Annexure” means the Annexure to these rules;

(c) “digital signature” means the digital signature as defined under clause (p) of sub-section (1) of section 2 of the Information Technology Act, 2000 (21 of 2000);

(d) “Director Identification Number” (DIN) means an identification number allotted by the Central Government to any individual, intending to be appointed as director or to any existing director of a company, for the purpose of his identification as a director of a company:

Provided that the Director Identification Number (DIN) obtained by the individuals prior to the notification of these rules shall be the DIN for the purpose of the Companies Act, 2013:

Provided further that “Director Identification Number” (DIN) includes the Designated Partnership Identification Number (DPIN) issued under section 7 of the Limited Liability Partnership Act, 2008 (6 of 2009) and rules made thereunder;

(e) “electronic record” means the electronic record as defined under clause (t) of sub-section (1) of section 2 of the Information Technology Act, 2000 (21 of 2000);

(f) “electronic Registry” means an electronic repository or storage system of the Central Government in which the information or documents are received, stored, protected and preserved in electronic form;

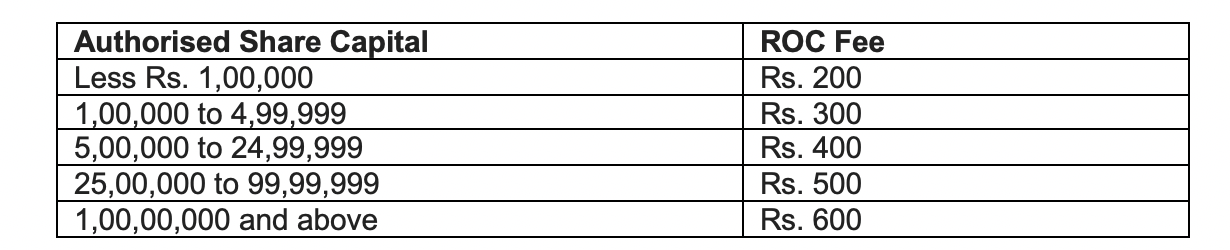

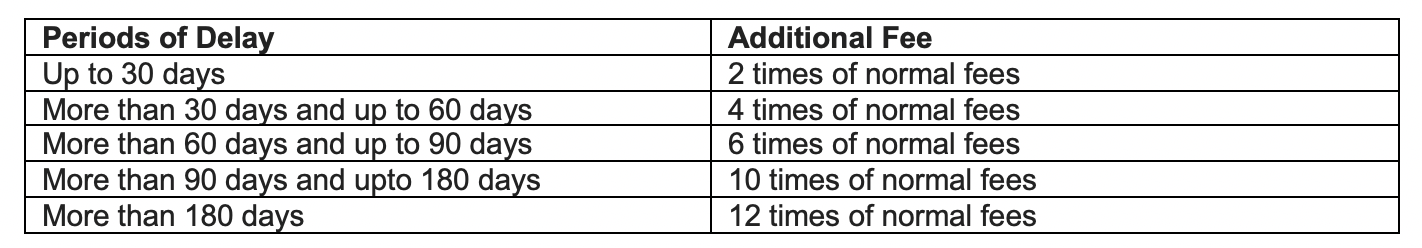

(g) ”Fees” means the fees as specified in the Companies (Registration Offices and Fees) Rules, 2014;

(h) ”Form” or “e-Form” means a form set forth in Annexure to these rules which shall be used for the matter to which it relates;

(i) “Regional Director” means the person appointed by the Central Government in the Ministry of Corporate Affairs as a Regional Director;

(j) “section” means section of the Act;

(k) For the purposes of clause (d) of sub-section (1) of section 164 and clause (f) of sub-section (1) of section 167 of the Act, “or otherwise” means any offence in respect of which he has been convicted by a Court under the Act or under the Companies Act, 1956.

(2) Words and expressions used in these rules and not defined but defined under the Act or under the Securities Contracts (Regulation) Act, 1956 (42 of 1956) or the Securities and Exchange Board of India Act, 1992 (15 of 1992) or the Depositories Act, 1996 (22 of 1996) or the Information Technology Act, 2000 (21 of 2000) or the Companies (Specification of definitions details) Rules, 2014 shall have the meanings respectively assigned to them in the Act or in those Acts or such rules.

3. Woman director on the Board.- The following class of companies shall appoint at least one woman director-

(i) every listed company;

(ii) every other public company having –

(a) paid–up share capital of one hundred crore rupees or more; or

(b) turnover of three hundred crore rupees or more:

Provided that a company, which has been incorporated under the Act and is covered under provisions of second proviso to sub-section (1) of section 149 shall comply with such provisions within a period of six months from the date of its incorporation:

Provided further that any intermittent vacancy of a woman director shall be filled-up by the Board at the earliest but not later than immediate next Board meeting or three months from the date of such vacancy whichever is later.

Explanation.- For the purposes of this rule, it is hereby clarified that the paid up share capital or turnover, as the case may be, as on the last date of latest audited financial statements shall be taken into account.

4. Number of independent directors.- The following class or classes of companies shall have at least two directors as independent directors –

(i) the Public Companies having paid up share capital of ten crore rupees or more; or

(ii) the Public Companies having turnover of one hundred crore rupees or more; or

(iii) the Public Companies which have, in aggregate, outstanding loans, debentures and deposits, exceeding fifty crore rupees:

Provided that in case a company covered under this rule is required to appoint a higher number of independent directors due to composition of its audit committee, such higher number of independent directors shall be applicable to it:

Provided further that any intermittent vacancy of an independent director shall be filled-up by the Board at the earliest but not later than immediate next Board meeting or three months from the date of such vacancy, whichever is later:

Provided also that where a company ceases to fulfil any of three conditions laid down in sub-rule (1) for three consecutive years, it shall not be required to comply with these provisions until such time as it meets any of such conditions;

Explanation. – For the purposes of this rule, it is here by clarified that, the paid up share capital or turnover or outstanding loans, debentures and deposits, as the case may be, as existing on the last date of latest audited financial statements shall be taken into account:

Provided that a company belonging to any class of companies for which a higher number of independent directors has been specified in the law for the time being in force shall comply with the requirements specified in such law.

5. Qualifications of independent director.- An independent director shall possess appropriate skills, experience and knowledge in one or more fields of finance, law, management, sales, marketing, administration, research, corporate governance, technical operations or other disciplines related to the company’s business.

6. Creation and maintenance of databank of persons offering to become independent directors. – (1) Any body, institute or association (hereinafter to be referred as “the agency”), which has been authorised in this behalf by the Central Government shall create and maintain a data bank of persons willing and eligible to be appointed as independent director and such data bank shall be placed on the website of the Ministry of Corporate Affairs or on any other website as may be approved or notified by the Central Government.

(2) The data bank referred to in sub-rule (1) shall contain the following details in respect of each person included in the data bank to be eligible and willing to be appointed as independent director-

(a) DIN (Director Identification Number);

(b) the name and surname in full;

(c) income-tax PAN ;

(d) the father’s name and mother’s name and Spouse’s name (if married) ;

(e) the date of Birth;

(f) gender;

(g) the nationality;

(h) the occupation;

(i) full Address with PIN Code (present and permanent);

(j) phone number;

(k) e-mail id;

(l) the educational and professional qualifications;

(m) experience or expertise, if any;

(n) any legal proceedings initiated or pending against such person;

(o) the list of limited liability partnerships in which he is or was a designated partner along with –

(i) the name of the limited liability partnership;

(ii) the nature of industry; and

(iii) the duration- with dates;

(p) the list of companies in which he is or was director along with –

(i) the name of the company;

(ii) the nature of industry;

(iii) the nature of directorship – Executive or Non-executive or Managing Director or Independent Director or Nominee Director; and

(iv) duration – with dates.

(3) A disclaimer shall be conspicuously displayed on the website hosting the databank that a company must carry out its own due diligence before appointment of any person as an independent director and “the agency” maintaining the databank or the Central Government shall not be held responsible for the accuracy of information or lack of suitability of the person whose particulars form part of the databank.

(4) Any person who desires to get his name included in the data bank of independent directors shall make an application to “the agency” in Form DIR-1.

(5) The agency may charge a reasonable fee from the applicant for inclusion of his name in the data bank of independent directors.

(6) Any person who has applied for inclusion of his name in the data bank of independent directors or any person whose name appears in the data bank , shall intimate to the agency about any changes in his particulars within fifteen days of such change.

(7) The databank posted on the website shall –

(a) be accessible at the specified website;

(b) be substantially identical to the physical version of the data bank;

(c) be searchable on the parameters specified in sub-rule (2);

(d) be presented in a format or formats convenient for both printing and viewing online; and

(e) contain a link to obtain the software required to view or print the particulars free of charge.

7. Small shareholders’ director.- (1) A listed company, may upon notice of not less than one thousand small shareholders or one-tenth of the total number of such shareholders, whichever is lower, have a small shareholders’ director elected by the small shareholders:

Provided that nothing in this sub-rule shall prevent a listed company to opt to have a director representing small shareholders suo motu and in such a case the provisions of sub-rule (2) shall not apply for appointment of such director.

(2) The small shareholders intending to propose a person as a candidate for the post of small shareholders’ director shall leave a notice of their intention with the company at least fourteen days before the meeting under their signatures specifying the name, address, shares held and folio number of the person whose name is being proposed for the post of director and of the small shareholders who are proposing such person for the office of director:

Provided that if the person being proposed does not hold any shares in the company, the details of shares held and folio number need not be specified in the notice:

(3) The notice shall be accompanied by a statement signed by the person whose name is being proposed for the post of small shareholders’ director stating –

(a) his Director Identification Number;

(b) that he is not disqualified to become a director under the Act; and

(c) his consent to act as a director of the company

(4) Such director shall be considered as an independent director subject to , his being eligible under sub-section (6) of section 149 and his giving a declaration of his independence in accordance with sub-section (7) of section 149 of the Act.

(5) The appointment of small shareholders’ director shall be subject to the provisions of section 152 except that-

(a) such director shall not be liable to retire by rotation;

(b) such director’s tenure as small shareholders’ director shall not exceed a period of three consecutive years; and

(c) on the expiry of the tenure, such director shall not be eligible for re-appointment.

(6) A person shall not be appointed as small shareholders’ director of a company, if the person is not eligible for appointment in terms of section 164.

(7) A person appointed as small shareholders’ director shall vacate the office if –

(a) the director incurs any of the disqualifications specified in section 164;

(b) the office of the director becomes vacant in pursuance of section 167;

(c) the director ceases to meet the criteria of independence as provided in sub-section (6) of section 149.

(8) No person shall hold the position of small shareholders’ director in more than two companies at the same time:

Provided that the second company in which he has been appointed shall not be in a business which is competing or is in conflict with the business of the first company.

(9) A small shareholders’ director shall not, for a period of three years from the date on which he ceases to hold office as a small shareholders’ director in a company, be appointed in or be associated with such company in any other capacity, either directly or indirectly.

8. Consent to act as director.- Every person who has been appointed to hold the office of a director shall on or before the appointment furnish to the company a consent in writing to act as such in Form DIR-2:

Provided that the company shall, within thirty days of the appointment of a director, file such consent with the Registrar in Form DIR-12 along with the fee as provided in the Companies (Registration Offices and Fees) Rules, 2014.

9. Application for allotment of Director Identification Number.-(1) Every individual, who is to be appointed as director of a company shall make an application electronically in Form DIR-3, to the Central Government for the allotment of a Director Identification Number (DIN) along with such fees as provided in the Companies (Registration Offices and Fees) Rules, 2014.

(2) The Central Government shall provide an electronic system to facilitate submission of application for the allotment of DIN through the portal on the website of the Ministry of Corporate Affairs.

(3) (a) The applicant shall download Form DIR-3 from the portal, fill in the required particulars sought therein and sign the form and after attaching copies of the following documents, scan and file the entire set of documents electronically-

(i) photograph;

(ii) proof of identity;

(iii) proof of residence;

(iv) verification by the applicant for applying for allotment of DIN in Form DIR-4; and

(v) specimen signature duly verified.

(b) Form DIR-3 shall be signed and submitted electronically by the applicant using his or her own Digital Signature Certificate and shall be verified digitally by –

(i) a chartered accountant in practice or a company secretary in practice or a cost accountant in practice; or

(ii) a company secretary in full time employment of the company or by the managing director or director of the company in which the applicant is to be appointed as director.

10. Allotment of DIN.- (1) On the submission of the Form DIR-3 on the portal and payment of the requisite amount of fees through online mode the provisional DIN shall be generated by the system automatically which shall not be utilized till the DIN is confirmed by the Central Government.

(2) After generation of the provisional DIN, the Central Government shall process the applications received for allotment of DIN under sub-rule (2) of rule 9, decide on the approval or rejection thereof and communicate the same to the applicant along with the DIN allotted in case of approval by way of a letter by post or electronically or in any other mode, within a period of one month from the receipt of such application.

(3) If the Central Government, on examination, finds such application to be defective or incomplete in any respect, it shall give intimation of such defect or incompleteness, by placing it on the website and by email to the applicant who has filed such application, directing the applicant to rectify such defects or incompleteness by resubmitting the application within a period of fifteen days of such placing on the website and email:

Provided that the Central Government shall –

(a) reject the application and direct the applicant to file fresh application with complete and correct information, where the defect has been rectified partially or the information given is still found to be defective;

(b) treat and label such application as invalid in the electronic record in case the defects are not removed within the given time; and

(c) inform the applicant either by way of letter by post or electronically or in any other mode.

(4) In case of rejection or invalidation of application, the provisional DIN so allotted by the system shall get lapsed automatically and the fee so paid with the application shall neither be refunded nor adjusted with any other application.

(5) All Director Identification Numbers allotted to individual(s) by the Central Government before the commencement of these rules shall be deemed to have been allotted to them under these rules.

(6) The Director Identification Number so allotted under these rules is valid for the life-time of the applicant and shall not be allotted to any other person.

11. Cancellation or surrender or Deactivation of DIN.- The Central Government or Regional Director (Northern Region), Noida or any officer authorised by the Regional Director may, upon being satisfied on verification of particulars or documentary proof attached with the application received from any person, cancel or deactivate the DIN in case –

(a) the DIN is found to be duplicated in respect of the same person provided the data related to both the DIN shall be merged with the validly retained number;

(b) the DIN was obtained in a wrongful manner or by fraudulent means;

(c) of the death of the concerned individual;

(d) the concerned individual has been declared as a person of unsound mind by a competent Court;

(e) if the concerned individual has been adjudicated an insolvent:

Provided that before cancellation or deactivation of DIN pursuant to clause (b), an opportunity of being heard shall be given to the concerned individual;

(f) on an application made in Form DIR-5 by the DIN holder to surrender his or her DIN along with declaration that he has never been appointed as director in any company and the said DIN has never been used for filing of any document with any authority, the Central Government may deactivate such DIN:

Provided that before deactivation of any DIN in such case, the Central Government shall verify e-records. Explanation.- For the purposes of clause (b) – (i) the term “wrongful manner” means if the DIN is obtained on the strength of documents which are not legally valid or incomplete documents are furnished or on suppression of material information or on the basis of wrong certification or by making misleading or false information or by misrepresentation; (ii) the term “fraudulent means” means if the DIN is obtained with an intent to deceive any other person or any authority including the Central Government.

12. Intimation of changes in particulars specified in DIN application. – (1) Every individual who has been allotted a Director Identification Number under these rules shall, in the event of any change in his particulars as stated in Form DIR-3, intimate such change(s) to the Central Government within a period of thirty days of such change(s) in Form DIR-6 in the following manner, namely;-

(i) the applicant shall download Form DIR-6 from the portal and fill in the relevant changes, attach copy of the proof of the changed particulars and verification in the Form DIR-7 all of which shall be scanned and submitted electronically;

(ii) the form shall be digitally signed by a chartered accountant in practice or a company secretary in practice or a cost accountant in practice;

(iii) the applicant shall submit the Form DIR-6;

(2) The Central Government, upon being satisfied, after verification of such changed particulars from the enclosed proofs, shall incorporate the said changes and inform the applicant by way of a letter by post or electronically or in any other mode confirming the effect of such change in the electronic database maintained by the Ministry.

(3) The DIN cell of the Ministry shall also intimate the change(s) in the particulars of the director submitted to it in Form DIR-6 to the concerned Registrar(s) under whose jurisdiction the registered office of the company(s) in which such individual is a director is situated.

(4) The concerned individual shall also intimate the change(s) in his particulars to the company or companies in which he is a director within fifteen days of such change.

13. Notice of candidature of a person for directorship.- The company shall, at least seven days before the general meeting, inform its members of the candidature of a person for the office of a director or the intention of a member to propose such person as a candidate for that office-

(1) by serving individual notices, on the members through electronic mode to such members who have provided their email addresses to the company for communication purposes, and in writing to all other members; and

(2) by placing notice of such candidature or intention on the website of the company, if any:

Provided that it shall not be necessary for the company to serve individual notices upon the members as aforesaid, if the company advertises such candidature or intention, not less than seven days before the meeting at least once in a vernacular newspaper in the principal vernacular language of the district in which the registered office of the company is situated, and circulating in that district, and at least once in English language in an English newspaper circulating in that district.

14. Disqualification of directors sub-section (2) of section 164.-

(1) Every director shall inform to the company concerned about his disqualification under sub-section (2) of section 164, if any, in Form DIR-8 before he is appointed or re-appointed.

(2) Whenever a company fails to file the financial statements or annual returns, or fails to repay any deposit, interest, dividend, or fails to redeem its debentures, as specified in sub-section (2) of section 164, the company shall immediately file Form DIR-9, to the Registrar furnishing therein the names and addresses of all the directors of the company during the relevant financial years.

(3) When a company fails to file the Form DIR-9 within a period of thirty days of the failure that would attract the disqualification under sub-section (2) of section 164, officers of the company specified in clause (60) of section 2 of the Act shall be the officers in default.

(4) Upon receipt of the Form DIR-9 under sub-rule (2), the Registrar shall immediately register the document and place it in the document file for public inspection.

(5) Any application for removal of disqualification of directors shall be made in Form DIR-10.

15. Notice of resignation of director.- The company shall within thirty days from the date of receipt of notice of resignation from a director, intimate the Registrar in Form DIR-12 and post the information on its website, if any.

16. Copy of resignation of director to be forwarded by him.- Where a director resigns from his office, he shall within a period of thirty days from the date of resignation, forward to the Registrar a copy of his resignation along with reasons for the resignation in Form DIR-11 along with the fee as provided in the Companies (Registration Offices and Fees) Rules, 2014.

17. Register of directors and key managerial personnel.- (1) Every company shall keep at its registered office a register of its directors and key managerial personnel containing the following particulars, namely:-

(a) Director Identification Number (optional for key managerial personnel);

(b) present name and surname in full;

(c) any former name or surname in full;

(d) father’s name, mother’s name and spouse’s name(if married) and surnames in full;

(e) date of birth;

(f) residential address (present as well as permanent);

(g) nationality (including the nationality of origin, if different);

(h) occupation;

(i) date of the board resolution in which the appointment was made;

(j) date of appointment and reappointment in the company;

(k) date of cessation of office and reasons therefor;

(l) office of director or key managerial personnel held or relinquished in any other body corporate;

(m) membership number of the Institute of Company Secretaries of India in case of Company Secretary, if applicable; and

(n) Permanent Account Number (mandatory for key managerial personnel if not having DIN);

(2) In addition to the details of the directors or key managerial personnel, the company shall also include in the aforesaid Register the details of securities held by them in the company, its holding company, subsidiaries, subsidiaries of the company’s holding company and associate companies relating to-

(a) the number, description and nominal value of securities;

(b) the date of acquisition and the price or other consideration paid;

(c) date of disposal and price and other consideration received;

(d) cumulative balance and number of securities held after each transaction;

(e) mode of acquisition of securities ;

(f) mode of holding – physical or in dematerialized form; and

(g) whether securities have been pledged or any encumbrance has been created on the securities.

18. Return containing the particulars of directors and the key managerial personnel. – A return containing the particulars of appointment of director or key managerial personnel and changes therein, shall be filed with the Registrar in Form DIR-12 along with such fee as may be provided in the Companies (Registration Offices and Fees) Rules, 2014 within thirty days of such appointment or change, as the case may be.