Our Services

Go to Home Page

+91-7210000746

info@fintaxx.in

Login

Private Limited Company (Pvt) Incorporation in India

Public Limited Company (PLC) Incorporation in India

One Person Company (OPC) Incorporation in India

Limited Liability Partnership (LLP) in India

Partnership Firm Registration in India

Startup India (DIPP) Registration

Trademark Registration (IPR)

Copyright Registration (IPR)

Patent Registration (IPR)

Design Registration (IPR)

Import Export Code (IEC) Registration

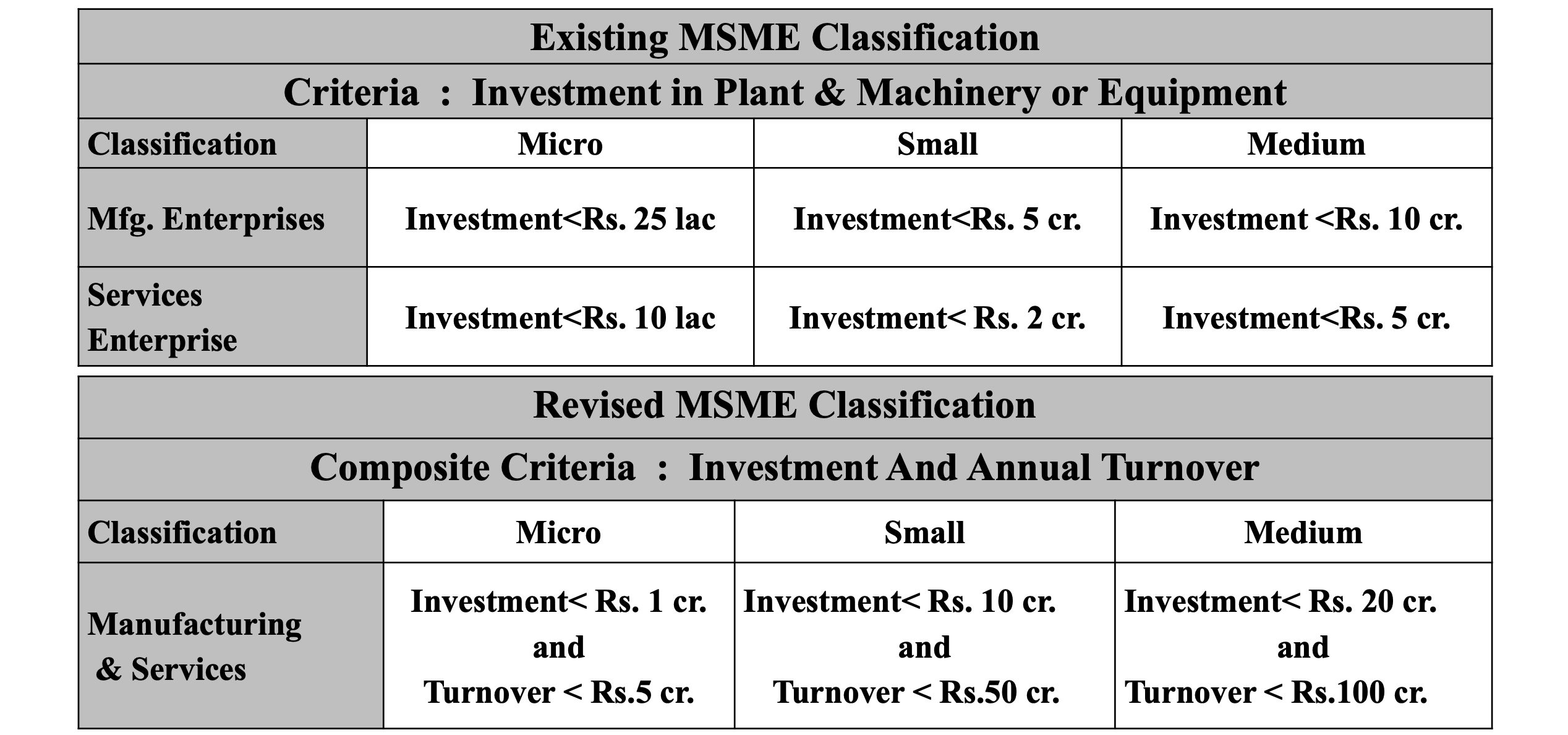

Udyog Aadhar or MSME Registration

Employee Provident Fund (EPF) Registration

Name Changes of Company

Removal of Director's Disqualification

Secretarial Audit

Compliance in Debenture/Bond Issue

Appointment of Company Secretary

Due Dilligence

Appointment of Additional Director

Strick off Company REVIVAL

Company Closure Voluntary

Merger, Demerger, Acquisition by Share

Company Dissolutions and Strike Off

Issue of Share/Debentures

Conversion of LLP into Pvt Ltd

Conversion of Pvt Ltd into LLP