The new company law provides for incorporation of various corporate forms of business companies, including a company limited by shares or/and guarantee, company with unlimited liability, special purpose vehicles, segregated portfolio company.

Since 2004, a number of significant amendments have been introduced in relation to the company incorporation and maintenance, among which the most interesting and "spectacular" ones are the company register of directors and implementation of the BOSS system.

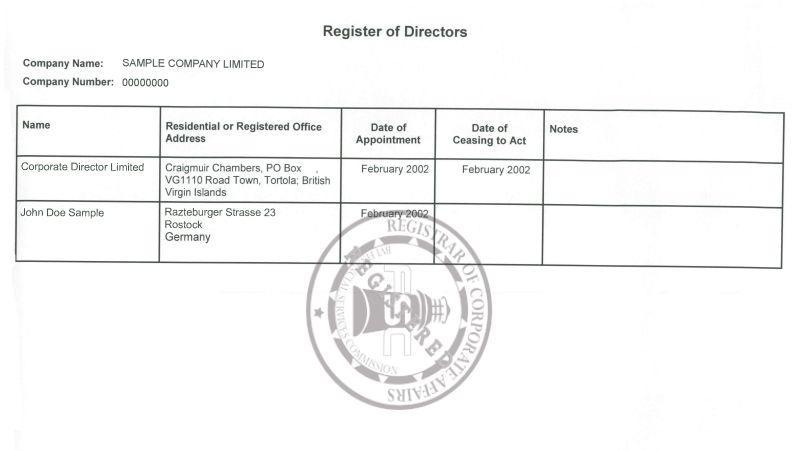

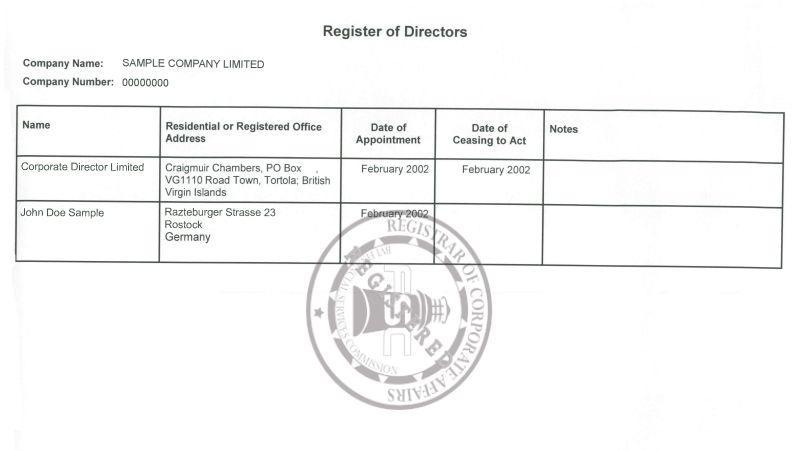

DIRECTORS:-

The list of the directors of a BVI company is not publicly available in general, even if the company has filed a Register of Directors. The reason for this is that most of the filings of Register of Directors are private. The company is not required to file this document as public. Most requested copies of this filing will only show that the company has filed a Register of Directors and not the names of the individuals as expected.

The Register of Directors is filed to the BVI Registry of Corporate Affairs using Form R410 titled "REGISTRATION TO REGISTER OF DIRECTORS/MEMBERS, THE BVI BUSINESS COMPANIES ACT, 2004, Section 231". The contents of the Register are in accordance with section 118 (1) of the Act.

The particulars of directors maintained in the Register include the following fields for individuals:

- Full Name

- Each former name (if any)

- Date of appointment or nomination of the individual as a Director or Reserve Director

- Date of cessation of the individual as a Director or Reserve Director

- Address for the service of documents

- Usual residential address (if different from service address)

- Date of birth

- Place of birth

In case of corporate directors the fields maintained are:

- Corporate name (name of the company or entity)

- Company number (corporate registration number if available)

- Date of appointment or nomination of the corporate entity as a Director or Reserve Director

- Date of cessation of the corporate entity as a Director or Reserve Director

- Registered office (or principal business address)

- Address (in case of a company incorporated in the BVI just the company number)

- Place of incorporation

- Date of incorporation

Newly incorporated companies in BVI have to file its register of directors within 21 days of the appointment of the first directors. It's mandatory for all companies to notify their registered agent of any changes in the Register of Directors within 15 days of the modification. For older companies incorporated before 1 January 2016 the deadline was 31 March 2017 and a penalty of US$8,000 was established. This penalty was reduced to US$5,000 on the Amendment of Schedule 3 (September 2018).

Companies that didn't file their Register of Directors by the end of 2018 will be struck off from the BVI Registry on 2 January 2019. So there will be no BVI companies without a Register of Directors filed by 2019.

Here's a sample Register of Directors. Please note that this document is available only for companies that file it as public. Most BVI companies file it as private.

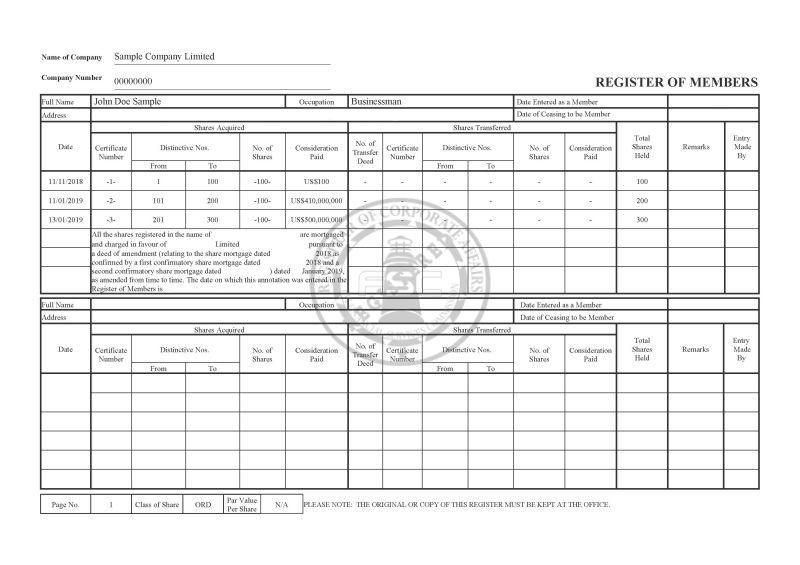

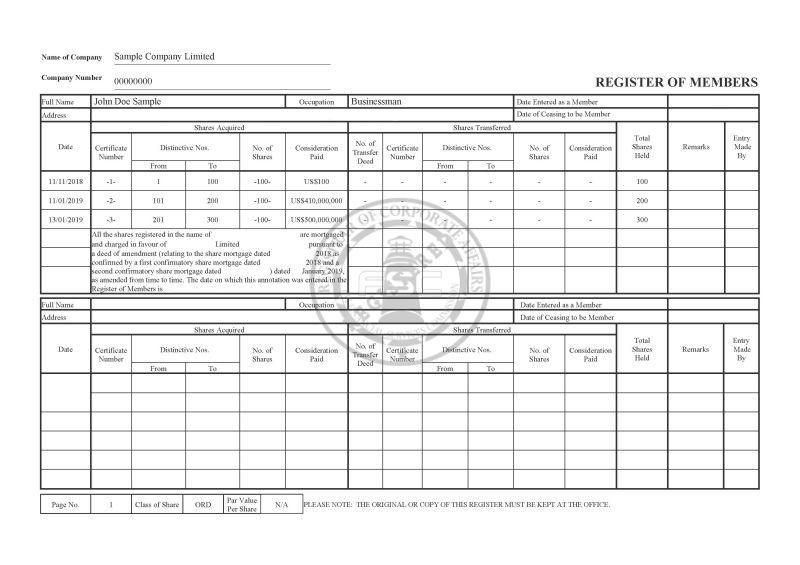

SHAREHOLDERS:-

Shareholders of BVI companies are listed in the Register of Members which is defined in section 41 of the Business Companies Act. They are not publicly available. There are three types of members:

- Shareholders holding registered shares

- Guarantee members

- Unlimited members

A company shall keep a register of members containing names and addresses of the shareholders along with the number and class of shares hold. Additional information include the date on which each shareholder was entered in the Register and the date on which the shareholder was ceased (if that's the case). Persons who are no longer members of a company may be deleted from the Register in accordance with section 41 (4)

In case that the company has the ability to issue bearer shares, the Register should contain the number and date of the certificate, number of bearer shares for each class and name and address of the approved custodian of the certificate

Unless the directors prevent it, the shareholders have right to inspect the memorandum and articles, the register of directors, the register of members and minutes of meetings. However the directors can oppose to this if they are satisfied that it would be contrary to the company's interests according to section 100 (3)

Here's a sample of a Register of Members. Please note that this document is not available for most BVI companies. Only in certain cases is filed to the Registry.

BENEFICIAL OWNERS:-

The ultimate beneficial owner of a BVI company is not available for the public. However, registered agents must keep the following information about the beneficial owner of a company:

- Full name

- Date of birth

- Residential Address

- Nationality

This information is required in accordance with the Anti-Money Laundering Regulations, Section 4 and it's a best practice KYC policy.

The Beneficial Ownership Secure Search System Act (BOSS) was introduced in 2017 and it's designed to be a searchable database of beneficial ownership information. However access to this database is restricted to BVI Authorities and it was designed with confidentiality in mind. The system was developed by Binder Dijker Otte (BDO). Authorities competent to use the secure search system include the Financial Services Commission, the International Tax Authority, the Financial Investigation Agency and the Attorney General's Chambers. This act applies only to business companies and not to trusts or partnerships. Registered agents have to enter and keep updated beneficial owner data within 15 days of identification of the beneficial owners. The required information to be entered in the system is the same as the one that registered agents have to hold in their internal records. The prescribed information is described in section 10 (3) of the BOSS Act.

FINANCIAL STATEMENTS:-

The requirements for financial records are detailed in section 98 of the BVI Business Companies Act 2004

A company shall keep records that are sufficient to show and explain the company’s transactions; and will, at any time, enable the financial position of the company to be determined with reasonable accuracy. A company that contravenes this section commits an offence and is liable on summary conviction to a fine of $10,000. So financial statements for a BVI company are not available because the company doesn't have to file them or even keep them at its Registered Office.

Independent audit of accounts is not required either with the exception of Segregated Portfolio Companies (SPC) in accordance to Section 159 (2)(b)(v) of the Act

SOME OTHER LEGAL REQUIREMENTS RELATED TO INCORPORATION

Notarization, Legalisation and Apostille:-

Documents filed by a BVI business company to the Registry of Corporate Affairs can be notarized by a BVI notary public. This also applies to documents retrieved from the Registry such as Certificates of Good Standing and company searches. Foreign countries may require the documents to be notarized and/or legalised if the foreign country is a member of the Hague Convention. The British Virgin Islands is also a member of the mentioned Convention so it's possible to Apostille documents that bear a BVI official signature. If the document lacks an official signature it has to be notarized first. Contact us if you require these services.

Company numbers:-

BVI Company numbers are numeric with no letters or other characters. The current BVI Business Companies Act 2004 (Number 16) appeared in the BVI Gazette on 29th December 2004 and came into force on 1st January 2005. On 1st January 2009 the companies that were incorporated under the previous Companies Act were re-registered under the current Act and their company number was changed adding 700,000 to it.

It's possible to conduct a search using the company number only. In fact this is actually faster than searching by company name as sometimes there are very similar names.

Some companies have their number as a name, for example "BVI Company Number 7432732 Limited" is a valid legal name of a BVI Company

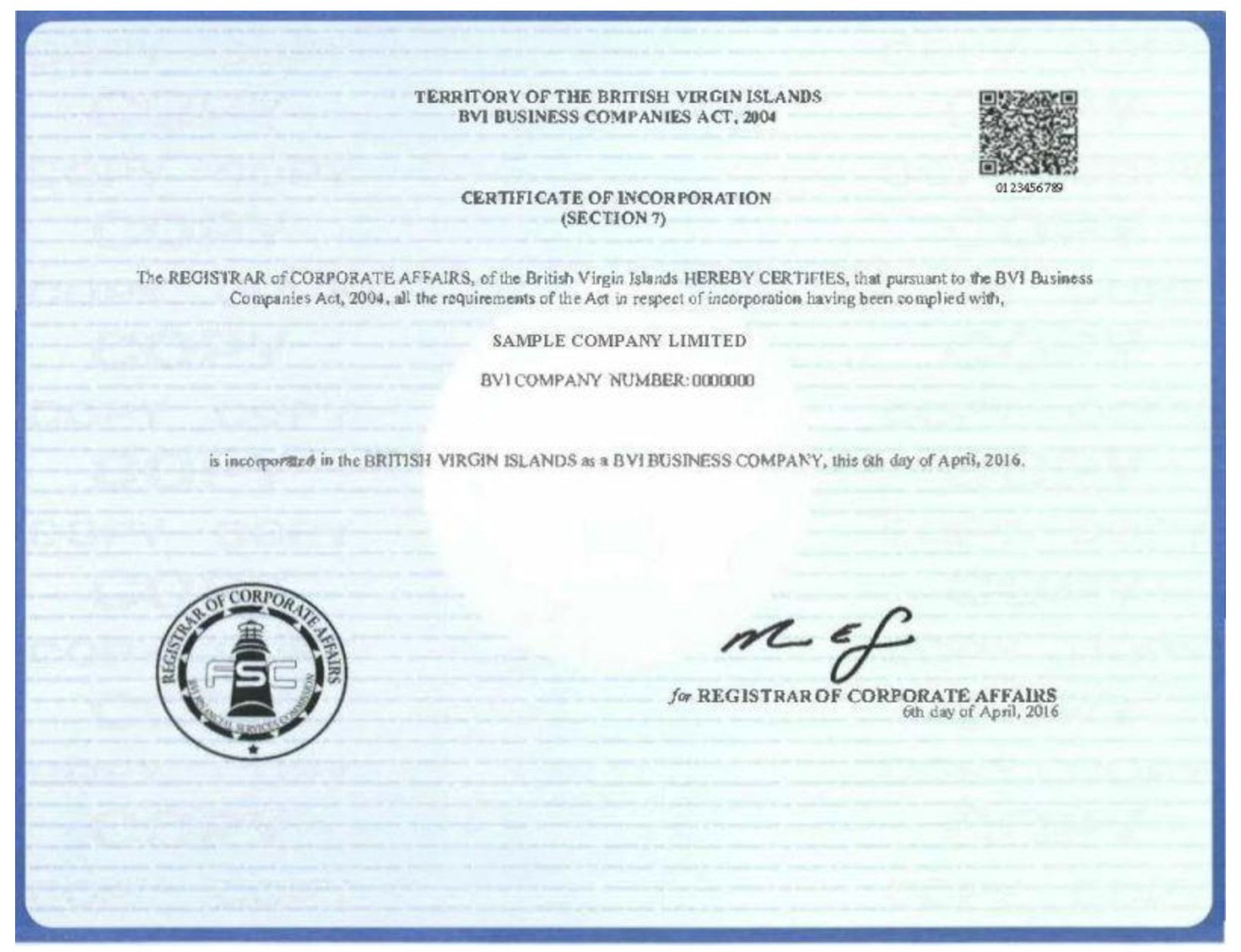

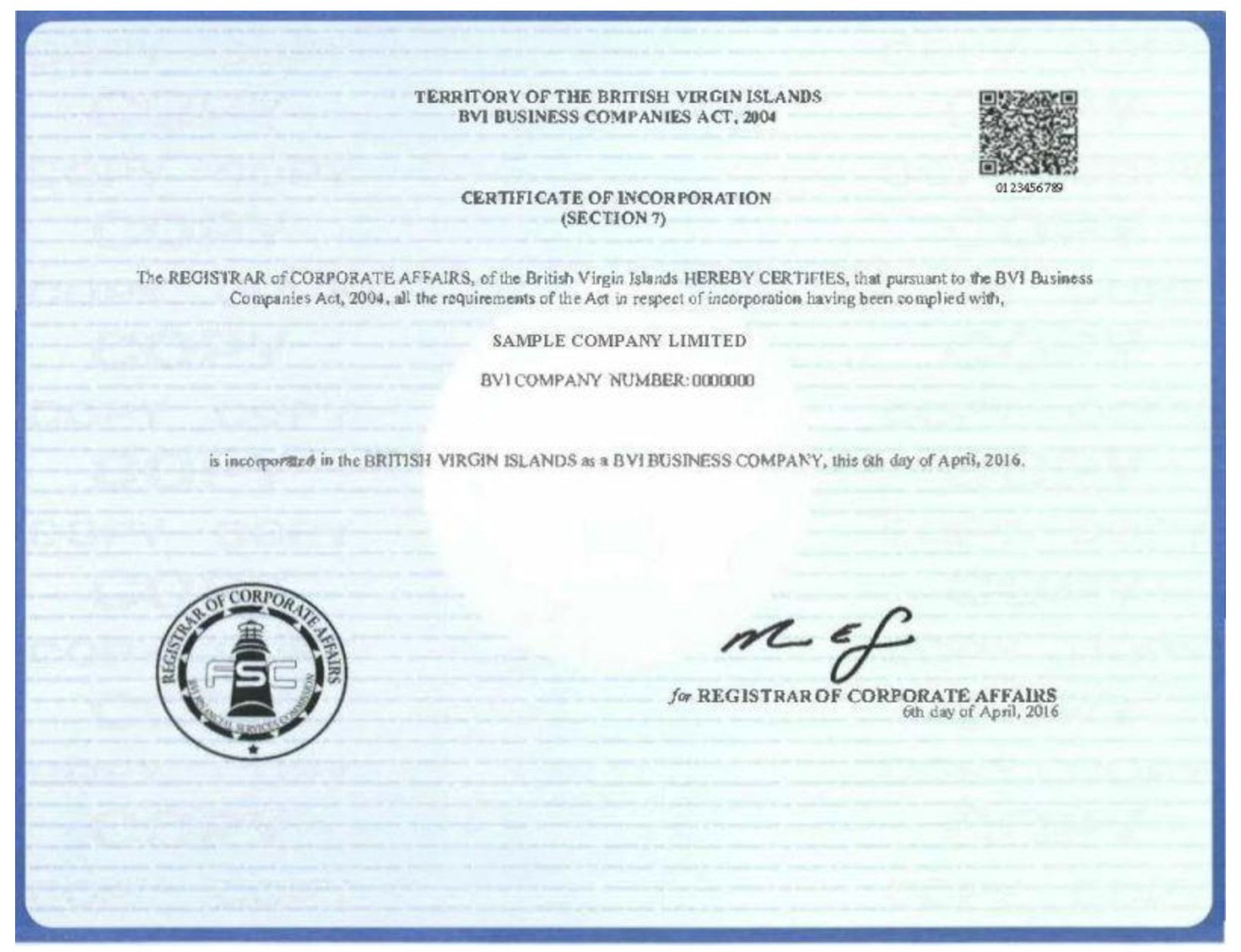

SAMPLE COPY OF CERTIFICATE OF INCORPORATION FOR KNOWLEDGE PURPOSES.